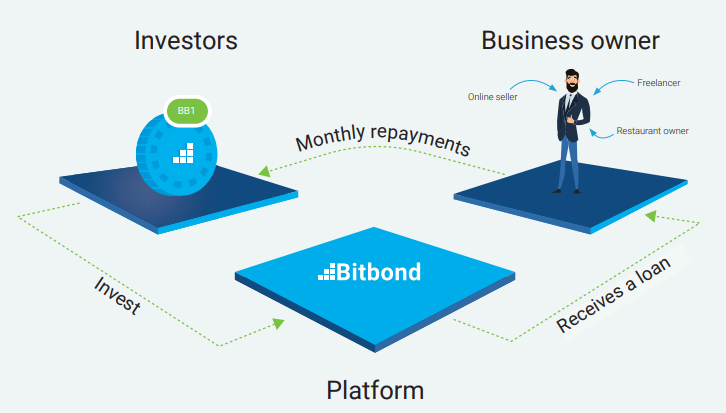

Bitbond is the first German Security Token Offering. Bitbond is a decentralized platform aiming at providing loans to small scale businesses at affordable prices.

Bitbond is the first decentralized commercial loan platform that operates in more than 80 countries around the world. Proiek is owned by Bitbond GmbH, società di ricerca di Berlino. The founding company owns one of the most serious financial licenses in the country provided by state financial regolatore. For the founders of Bitbond, this is a great honor and responsibility for clients and government institutions, also considering that this is the first chain block statement in the country to accept this license.

What must be emphasized in the history of the project is that, in its complete history of its existence since 2013, Bitbond GmbH has succeeded in establishing itself as a reliable partner in many countries in Europe and Africa. The company has opened credit lines per more than 3,000 small and medium-sized businesses worldwide, including at more than 13 million euros.

At present, the founders of Bitbond can provide monthly loans in the amount of around 1 euro, which is a valuable result, whose achievements, as claimed by the developer, do not intend to be terminated.

*Introducing BITBOND*

This fascinating Bitbond Security Token Offering (STO) infrastructure originated from the technically savvy Germany – Basically, it is a universal blockchain based infrastructure for lending. Since crackdown of ICO by SEC following the inability to meet the country’s financial security criteria, STO's are rapidly seen as the requisite alternative. The STO in a similar fashion with ICO's obviously are used to raise funds for establishments, however, owing to the fact that bodies charged with regulating it ensure its 100% lawful.

We have come to a point where decentralized platforms are important in our daily affairs. At the time digital assets became prominent with the launch of Bitcoin (BTC), no one expected that it would come this far. Just as these currencies improve digital transactions, they also help in solving real-world problems. Getting loans through centralized entities like banks usually entails going through stress, waiting for so long, and maybe at the end your loan won't be granted probably because it didn't meet requisites like collateral security. The Bitbond team want to curb this arising issues by enacting a more robust approach crypto lending solution.

Bitbond's mission is to make investments and financing available worldwide. Bitbond-token (BB1) is Germany's first security token and makes business lending available worldwide. Target income is 8%, more details with the calculations can be found in the calculator. This is due to a fixed coupon rate of 4% per annum and a high profit share of 60%.

BB1 Token is an excellent investment because the income is much higher than with other fixed income investments. BB1 Token is safer and more stable than other cryptographic investments because legally compatible prospectus regulates your rights. For the first time in Germany, real security is issued without the participation of banks.

Bitbond aims to effectively utilize a major fund raised during the STO in raising and bringing to standards SMEs by providing loans to these SMEs worldwide.

The Bitbond token Interestingly bit bond introduces its security token, a completely legal token with the BB1 which leverages on stellar to ensure access to loans for businesses. The BB1 is a safety token allotted by Bitbond Finance GmbH.

STO - every token here is protected by Bitbond shares, giving the owner the same voice payment and dividend payment as the original shareholder. Traditional financial systems have many intermediaries and applicants. Security tokens, in our case BB1 tokens using blockchain technology and fully digital infrastructure, can reduce and even eliminate many of the typical costs associated with the capital market, compliance with terms and securities trading. You get constant access to financial markets.

Bitbond runs a peer to peer lending network, home to a growing network of over fifty thousand investors having funded over thirty two thousand in loans worth over fifteen million united states dollars. With a promise of over 100% growth in the nearest future, plus the huge prospect of pulling some traditional finance institutions to assist in finance for businesses to thrive as they ought to… according to the founder of Bit bond.

Unlike other similar platforms as bit bond, its repayment plan is incredibly flexible, bordering between 0.5% and 1.5% of the sum payments. Importantly, bit bonds revenue comes from a fee charged borrowers termed origination fees.

*ADVANTAGES OF BITBOND*

Investors receive one percent of the total amount invested 4 times in a year meaning 4% per annum 60% of the pretax returns are paid out per annum. All coupons trimestral and annual inclusive run for ten years and after that, having hit peak is then returned to its initial value of 1 euro for a token.

Holders of the token will be sure of token transferability when once the token is transferred to their wallets after the subscription period elapses. Much more than other conventional block chains, the BB1 reduces the cost of global payment transactions, since the leverage on a more efficient block chain stellar. On course purchasing the token, the token holders will have instant access to a stellar wallet.

To cap it all, in a world of difficulties in doing business all over the world, finding a way to navigate these hurdles is a big step and one that is beneficial to small business owners. Furthermore, leveraging on effective cum efficient innovations to produce a user based platform such as bitbond is the deal breaker. Bitbond would transform the lending system using its STO powered by Stellar Blockchain.

The token publisher is Bitbond Finance GmbH, a company wholly owned by Bitbond GmbH. Bitbond is the first cryptocurrency based credit platform for business loans operating throughout the world. Founded in 2013, Bitbond currently attracts more than $ 1 million in business loans every month.

Lender of Coin: The main purpose of the project is to issue loans to various companies or businesses via digital money such as Bitcoin or Lumen. This process is done on the platform whereby borrowers who are signed in on the site make a request for loans, they are then issued the loans alongside with the interest rate accrued.

The issuer will inspect relevant documents for verification purposes, a credit assessment will also be carried out which is a run through check on the borrower's bank account transactions and business transactions.

Following the quest to utilize the infrastructure in this type of business, the issuer has to open a crypto account, through which he can invest in crypto loans. So, when the loan request comes in, and very well meets the issuer investment criteria i.e.(amount of loan, country of origin of the borrower, credit rating ) an agreement is brokered online directly between borrower and lender or investor.

Loans will be repaid based in the agreed term, reminders will be sent to borrowers asking him/her to credit wallet. If the borrowers’ status is in default, Bitbond takes over processes.

Network Lending: The issuer can also grant loans to the Bitbond network, having either fixed or varied interest rate. By doing this the economic success of the project is been contributed to by the issuer.

3.0 Comparing Token Bond to Customary Bond

3.1 Intermediaries: No intermediaries to be in charge of affairs, it is a direct P2P transaction, basically, the token will be issued by smart contracts directly investors wallet.

3.2 Programmability: Programmability always has been blockchain’s advantage over regular. In this case, all transactions are automatically executed, transaction including; payments, interest accrued and payback.

3.3 Risks: Take, for instance, if you borrow a sum of $500, the amount is transferred via crypto which is then converted to fiat the same conversation occurs when the money is to be paid back and at the current exchange rate. Hence exposure to volatility But the Bitbond team would operate using stable coins EURT.

To ensure the best experience, the first German security token will be released on the Stellar blockchain. Stellar is one of the most efficient blockchains for processing payments and issuing tokens, with processing capacity of over 1000 transactions per second, transaction costs per fraction of a percent, an integrated decentralized exchange and a global network of active partners using this platform.

With the end of the subscription period on July 8, Bitbond Finance will distribute all BB1 tokens to Stellar tokens holders. Wallets are created automatically upon purchase.

Bitbond STO not only offers investors a big profit, but also allows you to earn a commission for each friend who invests money.

*ROADMAP*

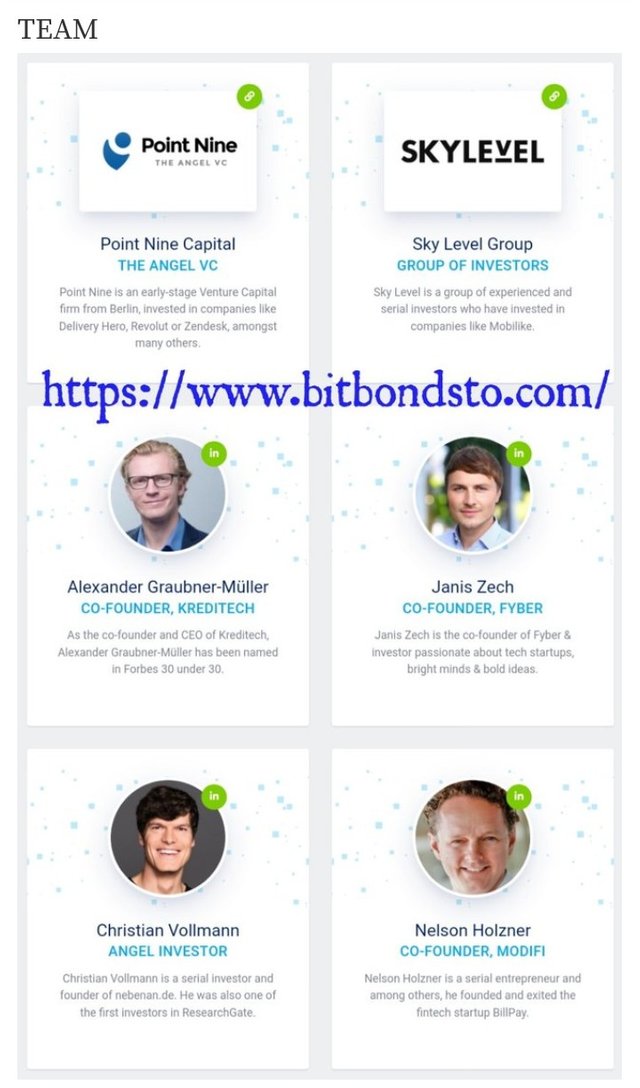

*TEAM*

Website: https://www.bitbond.com/

YouTube: https://www.youtube.com/user/Bitbond

Instagram: http://instagram.com/bitbondofficial/

Twitter: https://twitter.com/Bitbond

Facebook: https://www.facebook.com/Bitbond/

Telegram: https://t.me/BitbondSTOen

Prospectus Link: https://www.bitbondsto.com/files/bitbond-sto-prospectus.pdf

ETH Address: 0x5122481c8b397FE19A27F041E68579D128F2673c

Tidak ada komentar:

Posting Komentar