Viva is a home loan financing platform that offers large-scale decentralized mortgage financing worldwide. The Viva platform will use smart contracts to transfer home loans to large funds, to connect borrowers and investors directly to the ecosystem without proper guarantees. The Viva concept has been developed primarily to reduce interest rate inequality among world countries.

Viva will allow users to get investment incentives with techniques similar to those used by traditional banks. Decentralized technology will be used by Viva to develop the three main sectors of the current mortgage process, including mortgage financing, valuation of home equity and credit ratings.

The main objective of this project is to destroy the existing opaque mortgage industry, which allows existing buyers and sellers to independently regulate their own conditions. Anyone from any country in the world will be able to finance loans to buy home loans through a market network that has open market capitalization on the Viva platform.

In addition, the platform will guarantee free market risk and determine the value of each mortgage - unlike banks, the project team expects to see a fairer mortgage. The Viva platform will only be used for developed and developing countries, which will enable the world to take important steps towards geographical wealth equality - removing barriers and improving on both sides.

How Does Viva Work?

The platform is operated on a borderless and decentralized financing company for home loans that have been developed to eliminate the need to rely on middlemen like financial institutions and banks as well financial intermediaries. In order to create a brand new market in the mortgage industry, Viva will be used. The aim is to reduce the inefficiencies the industry has while making it more affordable to buy homes.

Private investors are permitted for the first time to buy high-end profitable, asset orient fractionalized mortgage shares. This also helps to innovate applications that have been designed to improve the current state and traditional credit scoring and appraisal procedures, often time outdated. The financial technology used in Viva is purposefully used to get larger decentralized loans to the people. The platform initiates smart contracts for use of funding home loans through crowdsales. And then it connects the investors with the borrowers p2p on the decentralized, trustless tech platform. The key to large transactions is strengthening the blockchain’s unbeatable security. Eliminating the middleman like Viva does, the loaning process becomes more profitable than ever before.

The company enables the free market to pick the going rate of interest a mortgage carries for the borrower. The need to have a bank or other financial service middleman is eliminated through the process and so are local financial institutions. Rates on the mortgage loans will naturally become fairer, reflecting the risk associated with it accurately in accordance with the assets true value. Viva started the process of decentralizing financial conglomerates power when the banks failed in 2008. Viva is now looking for ways to finish the process, thereby taking all power from the older, traditional and completely outdated financing systems – to leave them in the past, where they have belonged for a very long time.

*Viva Token*

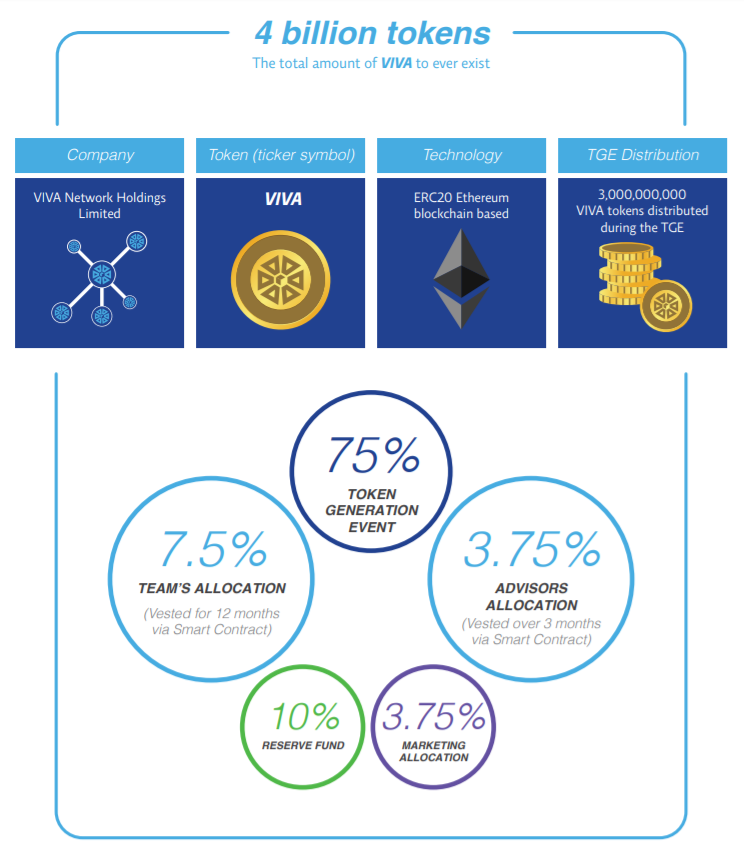

VIVA tokens (“VIVA”) are Ethereum blockchain based ERC20 tokens, designed to provide utility within. VIVA will act as ‘in-app currency’ serving as an integral driving force for the incentive-based ecosystem.

Token: VIVA

ICO start date: 2018-04-01

ICO end date: 2018-08-14

Price: 1 ETH = 35,714 VIVA

Platform: Ethereum

Receive: ETH

Tokens for sale: 4,000,000,000 VIVA

Minimum investment: 0.001 ETH

Hard stamp: 75,640 ETH

*Token Distribution*

* Token Generation Event Distribution - 75.00%

* Reserve Fund Allocation - 10.00%

* Marketing and Promotional Operations - 1.25%

* Private Contributions - 1.25%

* Bounty Program - 1.25%

* Advisor's Allocation - 3.75%

* Team's Allocation - 7.50%

Further information:

Website: http://www.vivanetwork.org/

WhitePaper: https://www.vivanetwork.org/pdf/whitepaper.pdf

Bitcointalk Subject ANN: https://bitcointalk.org/index.php?topic=3430485.0

Telegram: https://t.me/Wearethevivanetwork

Twitter: https://twitter.com/TheVivaNetwork

Author (morata): https://bitcointalk.org/index.php?action=profile;u=1074956

Tidak ada komentar:

Posting Komentar