The Vernam project is on an ambitious mission to change the insurance system by eliminating intermediaries.

More often than not, insurance requires risk management. Risk management is all about scoring carefully, diligently managing and transferring risk intelligently.

Despite the emergence of various types of insurance such as fire insurance, property insurance, life insurance, accident insurance, vehicle insurance, health insurance etc., the underlying operating model for all insurance companies has become an element called 'premium'. For your information, the most dominant insurance in Central and Eastern Europe is motor vehicle insurance. Since 2015, said InsurTech to be a keyword. This is a mashup of two words - Insurance and Technology. In the US, UK and Germany markets, investment in InsurTech is on the rise.

Despite the emergence of various types of insurance such as fire insurance, property insurance, life insurance, accident insurance, vehicle insurance, health insurance etc., the underlying operating model for all insurance companies has become an element called 'premium'. For your information, the most dominant insurance in Central and Eastern Europe is motor vehicle insurance. Since 2015, said InsurTech to be a keyword. This is a mashup of two words - Insurance and Technology. In the US, UK and Germany markets, investment in InsurTech is on the rise.

InsurTech companies do banking on large data to create customized services and insurance products. These companies use AI to switch from human-operated actions to fully automated routines.

Thanks to smart contracts and blockchain, efficiency and privacy are guaranteed, All is fine, but most of the value chain of insurance is associated with distribution. The main stakeholders in distribution are agents, brokers, underwriters, and insurance etc. As a result, the entire insurance process becomes progressively slower and boring.

*Future Plan*

VERNAM offers to build a market for various insurance products from various companies based on blockchain technology. Under Smart Contract, Insurance will be given to platform users. Because this platform works for customers worldwide and there are different laws in each country, they have created a worldwide Smart Insurance Contract registry for the purpose of connecting different lists from different countries.

The Vernam platform is mainly concentrated on crypto insurance that will change the insurance industry. This platform will lower the cost of insurance services by implementing blockchain technology solutions. The platform will also revolutionize the insurance industry by digitizing the insurance process.

The platform's Vernam platform is based on blockchain technology that is guaranteed and protected because there is no interference from unauthorized parties. This platform will create a market for insurance products from several companies that use blockchain technology.

The platform Vernam will provide innovative features which are as follows:

*Zero Commission Services

The platform Vernam will banish the middlemen’s from the insurance industry which charge the commissions, therefore, the services will be free from commission charges.

*Improve The Security And Transparency

The platform will provide a transparent and reliable process to protect the fund that will maximize trust of the customer and it will also banish arbitrators.

*Lower Insurance Premium

The platform using blockchain will decrease the insurance premium, which can save the data and records of the customers or clients insurance which will be useful for risk evaluation.

*Public-Private Section

The platform will facilitate two sections which are public and private sections in which private section allows to purchase the insurance products via smart contract to its clients.

Vernam uses blockchain technology to provide:

* Competitive online marketplace for conventional insurance products by the largest insurance companies.

* Generous compensation - up to 30% of the policy premium in Vernam token (VRN) is returned to the client.

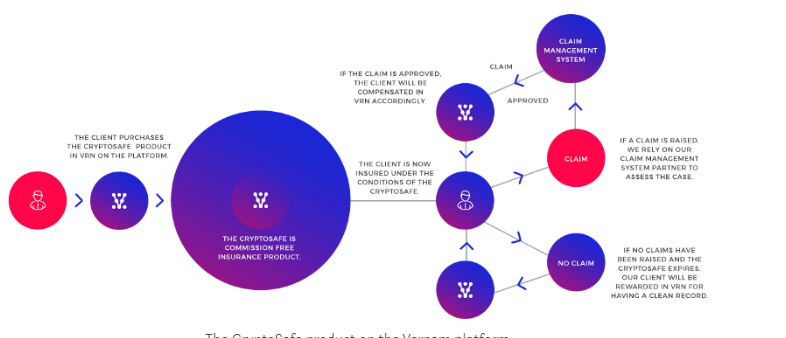

"CryptoSafe" - intelligent contract, ensuring that when a series of events is established, the client will be compensated with a certain number of Vernam Tokens (VRNs). The newest and most innovative blockchain-based insurance product Vernam will introduce.

Vernam market solves the problem. Markets are associated with a shared ledger that not only increases transparency but also minimizes transaction costs. Data manipulation by unauthorized parties is prevented. VRN Token (Vernam) (the standard Ethnicum-based token ERC20) is used to make full use of this platform. Clients can purchase conventional insurance through this market. They will receive an award in the form of a VRN token whose value is the same as the broker's commission.

Vernam market solves the problem. Markets are associated with a shared ledger that not only increases transparency but also minimizes transaction costs.

Data manipulation by unauthorized parties is prevented. VRN Token (Vernam) (the standard Ethnicum-based token ERC20) is used to make full use of this platform

1,000,000,000 VRN Tokens are created for the project in which 50% will be available for the ICO. 30% OF THE funds will be used in the marketing of the platform while 25% of the funds will be used for the legal and admin purposes.

30% of the token sale funds will be allocated to cover social platform and other marketing channels, including website and content development, the organization of events, etc.

Legal and administrative fees will be substantial, given the platform’s target of registering brokers in two EU countries by Q2 2019 and covering 8 countries by the end of 2020, Therefore 25% of the token sale funds will be directed to cover such expenses. The remaining 20% will be used for network development.

*Milestones*

Vernam platform expect to distribute about 1 million VRN tokens to its shareholders and it will allocate as follows:

*50% --- distributed through public token sales.

*20% ---- reserved in the Cryptosafe insurance fund.

*15% --- allocated to founders and team.

*Remaining 3% --- distributed through the bounty programs.

*Token allocation*

Start Of token crowdsale : April 2018

Token name : Vernam Token

Token symbol : VRN

Total VRN token amount : 1,000,000,000

VRN Hard Cap : 500,000,000 VRN

Conversion Rate : 1 VRN = 0.051–0.085 USD

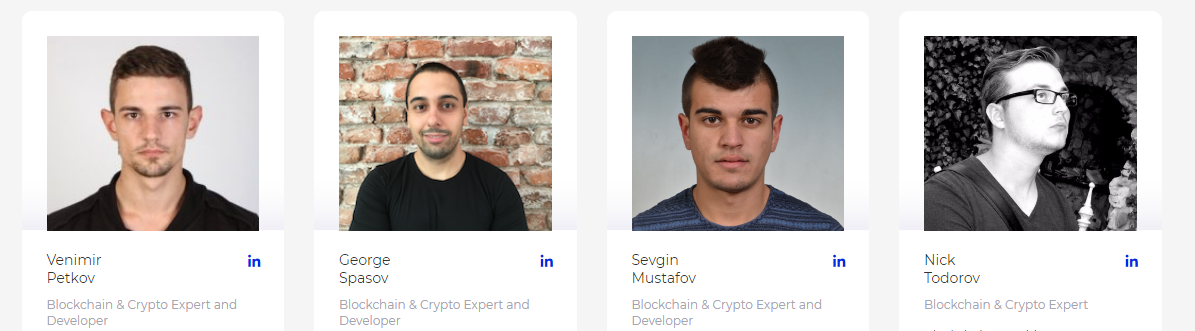

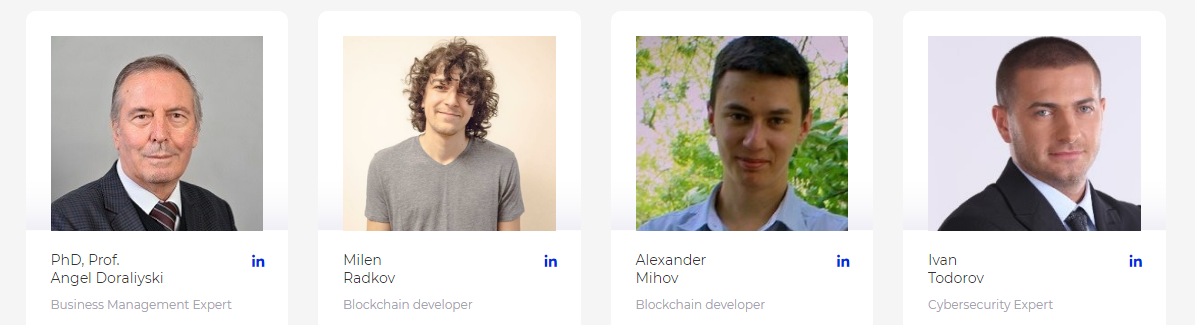

*TEAM*

The team is very enthusiastic about developments in the insurance sector with the introduction of their platform. They are open to collaborating with like-minded people.

The vernam team consists of people with experience in the field of insurance and blockchain technology, and has the support of an advisor who will continue to provide input for Vernam's future development.

*Conclusion*

There are many insurance companies that want to cover everything you have. They are ready with countless proposals to meet your needs and they have quite a fairly clear success of their Market capitalization. The insurance industry is stable and successful. They are an industry worth 4.73 trillion dollars. It is suitable for every situation in life, they have made you insured. The insurance market is ready for revolution. They plan to expand the future in other countries in the European Union. While there are still many obstacles in realizing the full potential of the platform, they are working hard to achieve a milestone.

Getting insurance will be much easier when you have all the information, and this platform aims to lead in the positive direction of open information about the product. Standardizing information and procedures regarding insurance for a person is the ultimate goal of the platform.

Further information:

Website: https://www.vernam.com/

Telegram: https://t.me/vernam

Twitter: https://twitter.com/vernamofficial

Author (morata): https://bitcointalk.org/index.php?action=profile;u=1074956

Tidak ada komentar:

Posting Komentar