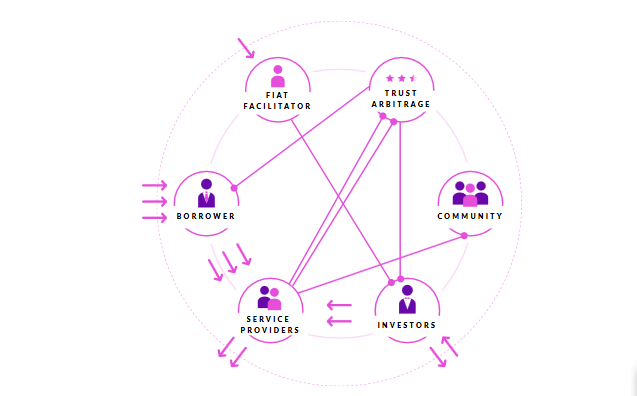

The Debitum Network is designed to bring together borrowers and people who help them implement them: investors (lenders), risk assessors, document validators, insurance companies, etc. Companies or individual professionals working in an alternative financing space can connect to the network for free and immediately begin facilitating cross-border transactions.

The Debitum Network is built as a hybrid platform. All actions are processed through Ethereal Blockchain, making the Network Debitum a secure and non-destructive infrastructure. It consists of a family-based smart contract based on Ethereal, which is facilitated by one way of internal payments.

Transactions run through Fiat currency, ensuring businesses can actually use these services easily in their region, and from day one.

The Debitum Network is built as a hybrid platform. All actions are processed through Ethereal Blockchain, making the Network Debitum a secure and non-destructive infrastructure. It consists of a family-based smart contract based on Ethereal, which is facilitated by one way of internal payments.

Transactions run through Fiat currency, ensuring businesses can actually use these services easily in their region, and from day one.

*INTRODUCING*

In accordance with statistical data from world banks, that about 70% of all micro, small and medium enterprises in emerging markets have no access to credit. Though the sector very plays a big role in the local/global economy. Especially according to world bank data estimates that informal companies around the world have an additional credit gap of about $ 1 trillion. this gap is deeply felt in the global economy, and the banking industry to date cannot solve this problem. Therefore, we will develop a platform that will solve this problem using alternative methods or called ‘alternative finance’, which will provide alternative financing solutions such as peer-to-peer lending (P2P), crowdfunding, balance-sheet lending, invoice trading (loan backed by account receivables), supply chain finance, reverse factoring, merchant loans, VAT financing, and others. We will debate this gap, by creating a platform named “DEBITUM".

*Getting Started Development*

We will build a platform that will engage SMEs with traditional banks, where we will provide solutions for SMEs who are finding it difficult to raise funds, so they can grow and grow and ultimately they can directly access traditional financial instruments. We will give users easier access, in addition they will get higher operating speed and convenience. Users will gain access to financial instruments faster than regular banking. Regarding our belief in users, we will use a blockchain system, which in turn will manage in such a way as to the system and user loan procedures, so that we are not overly concerned about the trustworthiness of users.

*Reasons We Choose Blockchain*

We designed this platform to run using blockchain technology as the basis for our platform development. Because from the first appearance, blockchain comes with the offer of fast and secure online transactions and supports all types of data and cryptocurrency. Blockchain technology uses a system, where every transaction is recorded and can not be changed forever, so transaction security and transparency can be maintained and reduce the chance of cheating data.

We prefer to use blockchain technology because this technology is more secure than the usual technology today. Unlike conventional technology, blockchain technology does not require a third party, so it’s safer and cost-effective. And blockchain technology is more minimal system error, so this technology is better and reliable.

*True decentralization*

We will make this platform work with a truly decentralized system, we will put our users in one place, a ‘community’, which contains various service providers and companies, which they will be able to finance ‘borrower’ alternatives to various SMEs. With the Debitum network, we will make this community work together as one service provider, which in turn will provide a better experience in this financial business.

*In conclusion*

We believe that with the system we have designed, we can address the gaps that traditional banking cannot overcome at this time. And we believe that blockchain and cryptocurrency technology is the most important part of it, and we are sure to have a platform that is safer and better than similar platforms.

How DEBITUM Works ?

* Donate Contribute to the Debitum Network and get your DEB token.

* Debitum Network - a small business financing solution

- Fernando runs a timber company in Brazil and wants to export his production to the Netherlands.

- Currently Fernando has no money for the growth of international business, he sells all his produce at a fairly cheap price to Alex, an intermediary who takes care of business development in the Netherlands and logistics.

- Fernando finds the Debitum Network and submits a loan application of 20,000 USD with an interest rate of 12%, gives his production in the warehouse as collateral.

- Many investors from the United States and Europe decided to finance Fernando and give him a loan of 20'000 USD.

- Fernando is glad to see his business grow because he has more money. As Fernando managed to build up his operations in the Netherlands with the help of his friend Sarah, the investor repaid his loan.

* Your profits grow with the Debitum Network

We use your contribution to fully launch our solutions in many markets. Anyone with spare money can join the Debitum Network and lend to Fernando or any other company. As the Debitum Network grows worldwide, with a very limited number of DEB tokens on the market, the value of the token obtained can increase by about 10x times.

*Why Investors Target As Top ICO*

* We can start fast and grow fast.

We are already experts in decentralized alternative financing. There is a network of individual investors and fully functional international funds, plus funding requests from SMEs, who are already waiting. We just need that fuel.

* Debitum (DEB) - This is sustainable.

The Debitum Token will trigger any transaction on the Debitum Network. Thus, being a sustainable crypto that will grow in value over time as the eco-system Debitum becomes wider.

* We have developed functional MVP.

Full Blockchain Infrastructure Runs at ETH Based on demand for real financing from SMEs.

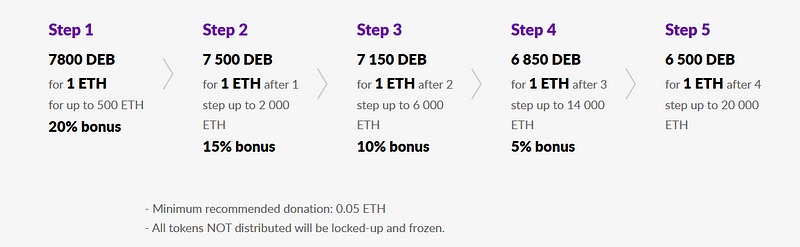

*Sales Token*

Name: Debitum (DEB) Supply: 400 million tokens.

Hard cap: 24,000 Ether (ETH)

*Round A (community round)*

Round A starts on 7 December 2017 at 15:00 GMT.

Round A ends 21. December 21, 2017 at 15:00 GMT.

The results collected 1.2 million USD.

*Round B*

Round B will start on January 25, 2018 at 15:00 GMT.

Round B end February 25, 2018 at 15:00 GMT.

Wrap Round B: 20,000 Ether (ETH).

*TOKEN SALES *

With this opportunity, we invite you to enlarge this Platform, to reach the Broader Society. We will release the Token under the name “Debitum (DEB) Token ”, here is the data.

• Token name: Debitum (DEB)

• Blockchain: Ethereum-based ERC223 token

• Crowdsale: The Stage 1 Crowdsale from December 7th

• 400 million Debitum tokens

• Stage 1 Crowdsale the Hard cap is: Round A 4,000 ETH, Round B 20,000 ETH

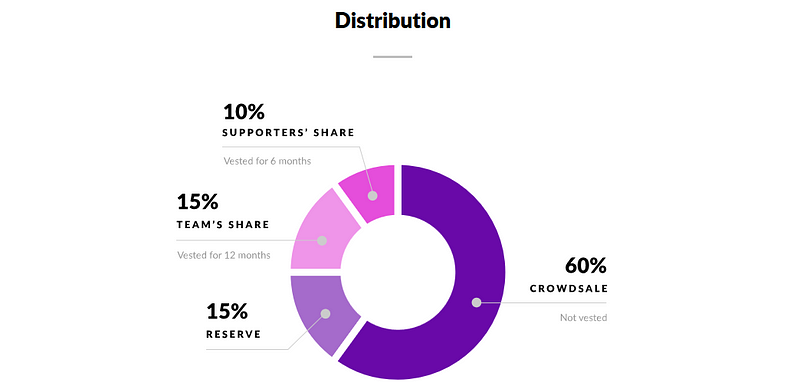

*Distribution*

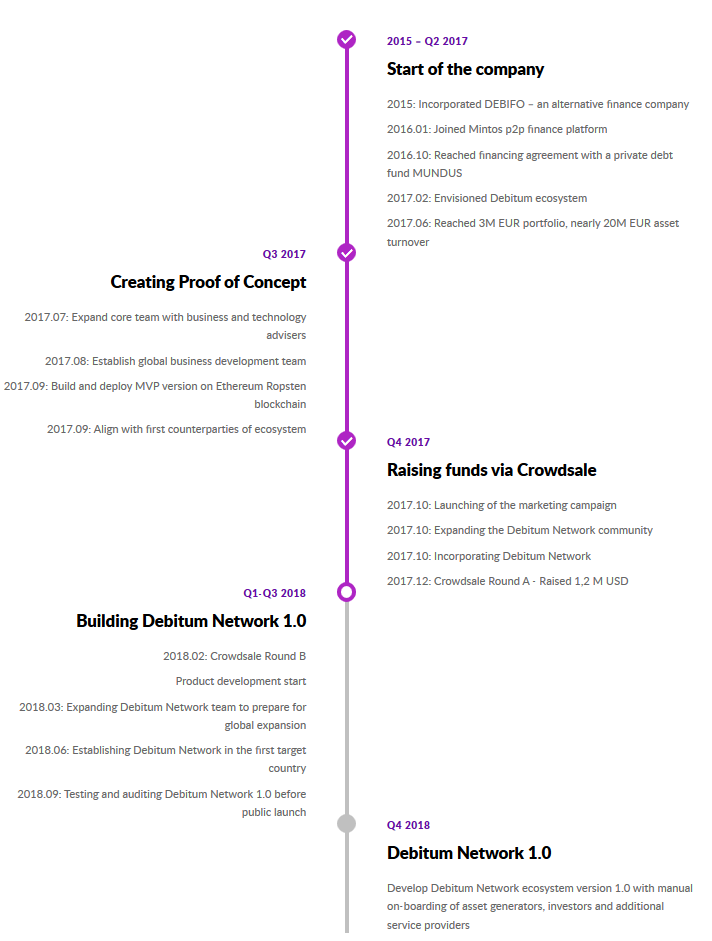

*ROODMAP*

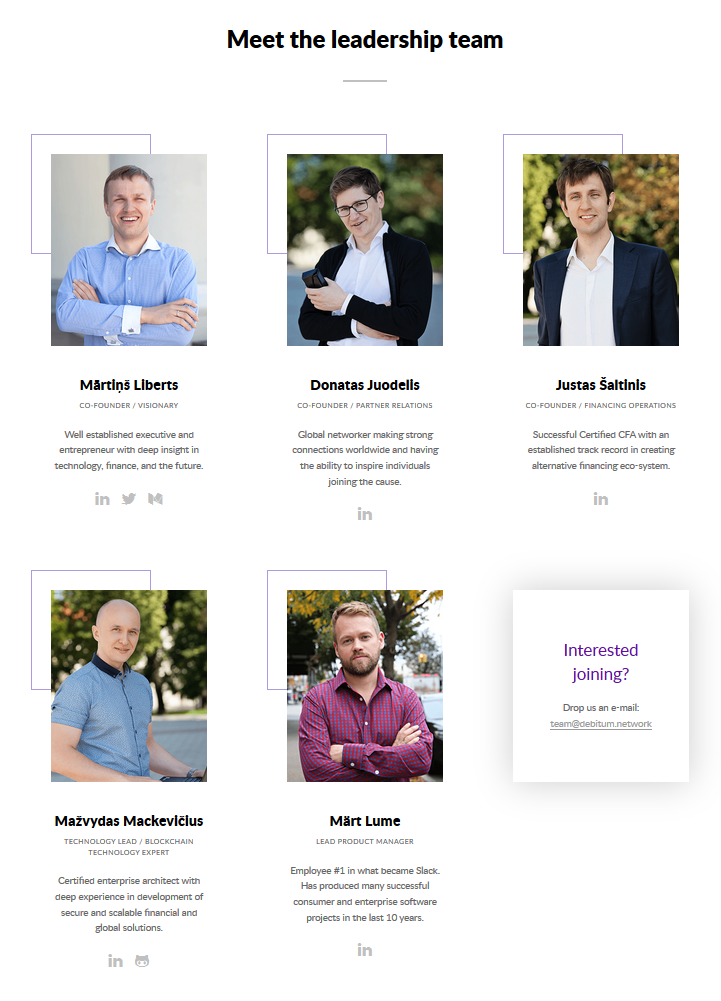

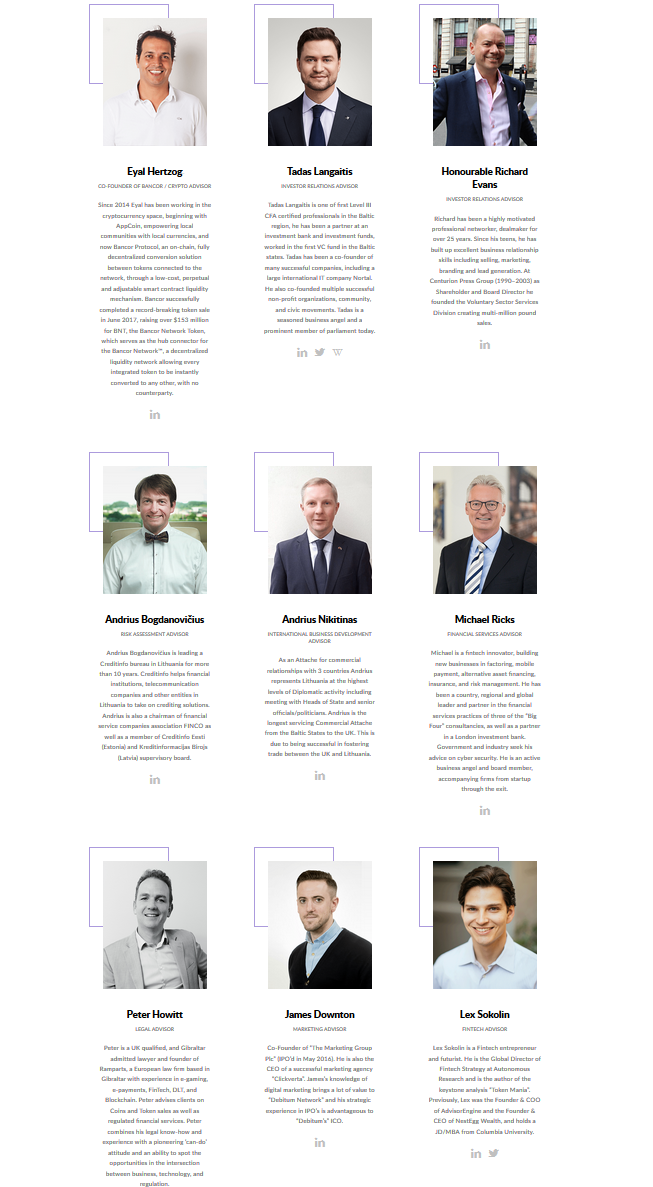

*TEAM*

Website: https://debitum.network/

Whitepaper: https://debitum.network/whitepaper

Telegram: https://t.me/joinchat/G6KFmURKsu0FIfJetJ3mOA

Twitter: https://twitter.com/DebitumNetwork

Facebook: https://facebook.com/DebitumNetwork

Author (morata): https://bitcointalk.org/index.php?action=profile;u=1074956

Tidak ada komentar:

Posting Komentar